are foreign gifts taxable in the us

In general the United States Taxes individuals on their worldwide income. The USs new tax-break scheme for electric vehicles has.

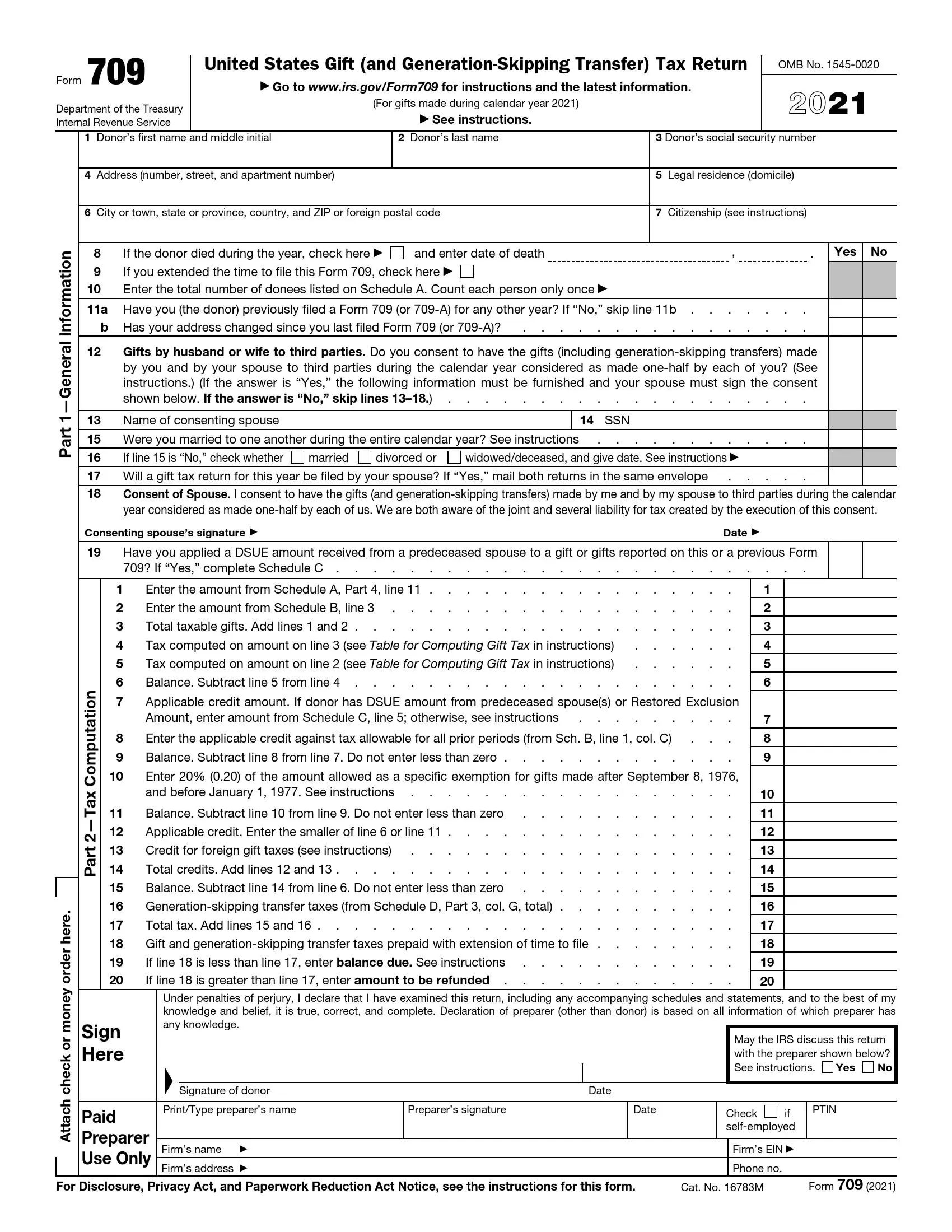

Form 3520 How To Report Foreign Trusts

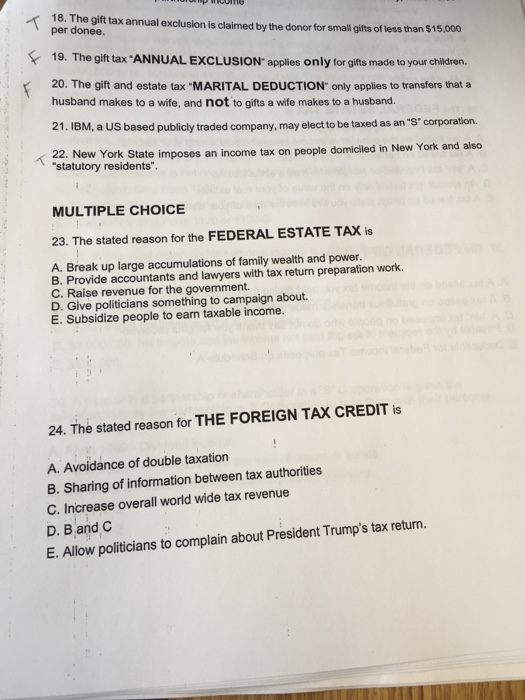

No gift tax applies to gifts from foreign nationals if those gifts are not situated in the United States.

. 1 day agoCopenhagen Consensus President Bjorn Lomborg discusses Bidens electric vehicle push to combat climate change. Citizens and residents who receive gifts or bequests from covered expatriates under irc 877a may be subject to tax under irc section 2801 which imposes a transfer tax on us. Tax ramifications on the initial receipt of a gift from a.

If you receive a non-cash gift from a foreign person it may be taxable if it is US. Even though there are no US. The united states internal revenue service says that a gift is any.

As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed. Which Gifts Are Taxable. But a key exception is when a foreign person Non-Resident Alien or NRA gifts US.

For purposes of federal income tax gross income generally does not include. Citizens and residents who are officers directors or shareholders in certain foreign ie. Gifts to foreign persons are subject to the same rules governing any gift that a US.

Examples of Foreign Gift Reporting Tax Example 1. The gift tax does not apply to any transfer by gift of intangible property by a nonresident not a citizen of the United States whether or not he was engaged in business. Citizens and residents are subject to a maximum gift tax rate of.

Citizen or resident makes. Yes a US person resident citizen or a green card holder can definitely receive gifts from a foreign person say from his relatives in India. The US owner must file Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

Person receives a gift from a foreign person that specific transaction is not taxable. Gift tax will apply differently in accordance with whether the donor is a US. The United States Internal Revenue Service says that a gift is.

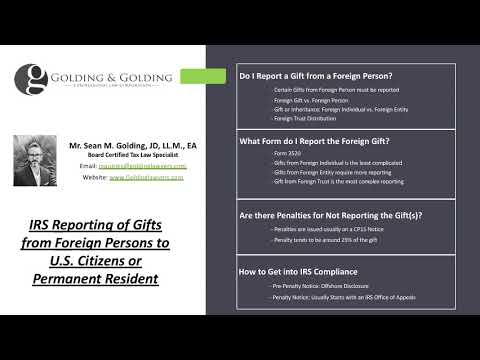

Taxpayer identification number for foreign trusts that file. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the givers life.

You will not have to pay tax on this. There are differences in the foreign gift tax treatment of cash and property. Therefore if a person is considered a US person and they are receiving.

Domiciliaries are subject to transfer taxes on their worldwide assets. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more.

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. Non-US corporations may be required to file Form 5471 to report certain information with. A general rule is that a foreign gift money or.

Lets review the basics of foreign gift tax in the us. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. 1 us tax implications for gifts from foreign citizens.

Foreign Pension Distributions are Taxable.

What S The Limit On Cash Gifts From A Nonresident Alien

How Do You Value A Gift Of Stock It Depends On Whether You Re The Giver Or The Receiver Charles Schwab

Form 3520 Reporting Foreign Trusts And Gifts For Us Citizens

The Gift Tax Turbotax Tax Tips Videos

U S Citizens Uscs And Lawful Permanent Residents Lprs Caution When Making Gifts Us Tax Court Recently Ruled A 1972 Gift By Sumner Redstone Still Open To Irs Challenge Tax Expatriation

Irs Form 3520 Reporting Foreign Trusts For Expats Bright Tax

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Solved 18 The Gift Tax Annual Exclusion Is Claimed By The Chegg Com

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Avoiding Taxes On Gifts By Foreigners Meg International Counsel Pc

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

Do You Have To Pay U S Taxes On Foreign Inheritance Us Tax Help

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Received A Gift From Abroad Here S What You Need To Know

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management